In 1992, Ross Perot famously stated that NAFTA would cause a “giant sucking sound” as jobs and industries fled the U.S. for Mexico. For years, progressive Vermont’s bloated bureaucracy has increased regulations, social programs, and both income and real estate taxes in the fantasy that the rich can just be taxed more to achieve every imagined social good. But the COVID-19 crisis has pulled aside the fiscal veil, and now the Green Mountain State is careening into the red. A “giant sucking sound” is heard from Vermonters fleeing the state.

Vermont has stubbornly avoided funding its state pension system. It “boasts” the second-highest per-pupil school costs in America, the fourth-highest healthcare costs, and the fourth-highest welfare benefits. Unsurprisingly, it also distinguishes itself as the 49th worst business climate, and the only state to have its credit rating downgraded in 2019 -- when economic times were relatively good.

Liberals scoff at supply-side economics (the idea that cutting taxes causes a “trickle-down effect” that boosts investment, income, and ultimately tax receipts). But taxes DO matter. As a tax attorney, much of what I studied was taxpayer behavior in response to tax code changes -- each change creates new loopholes, necessitating more refinements. This is also sometimes called “human nature.”

Vermont’s state economists now caution that the state could lose $430 million in tax revenue next year due to this crisis, which is a lot of money when the population is merely 628,000. Voters must anticipate that the real number is likely much higher. As Vermont weighs how to fill in that gap, an analyst with the government warns “...if lawmakers don’t find another source to replace the lost revenue in the education fund, property taxes would have to go up dramatically in the next fiscal year.”

Of course, that’s just the education fund! And while Vermont wrangles to secure federal funds to bail itself out, blames the virus for its woes, and shelves its ambitious plans to implement new gasoline taxes and subsidies for Electric Vehicles (to save the planet!), it shuns the very concept of reduced government spending. That’s because in Vermont, the fat cats have government jobs while the citizens lose income.

Many Vermonters have already packed up and fled. More are preparing to do so. If there is a mass exodus, property prices may plummet, allowing wealthy out-of-staters to buy up properties cheaply -- that is, IF they are prepared to shoulder those skyrocketing real estate taxes. (Vermont ranks sixth-highest property taxes in the nation; but only 23rd in median income). .

Many argue that the response to COVID-19 must be directed by medical knowledge, but economic reality hangs over Americans like a second guillotine. We must not ignore the best medical knowledge available, but neither should we rely solely on physicians for our economic prescription.

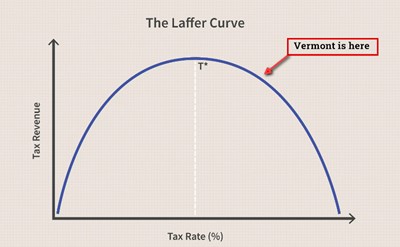

In considering what economists teach, we return to that much-derided “trickle-down theory” to search for lessons. The general idea is that raising taxes actually reduces tax receipts. One model for consideration is the Laffer Curve, which represents the effect on behavior of rising tax rates. At some point, raising taxes decreases rather than increases government revenue:

A business is more likely to find ways to protect its capital from taxation or to relocate all or a part of its operations overseas. Investors are less likely to risk their capital if a larger percentage of their profits are taken. When workers see an increasing portion of their paychecks taken due to increased efforts on their part, they will lose the incentive to work harder. Put together these could all mean less total revenue coming in if tax rates were raised.

As Vermont searches for more pockets to pick, its progressive masters will scorn the Laffer model, arguing that cutting taxes helps the wealthy only (John Kenneth Galbraith famously described trickle-down theory as “feeding the sparrows by giving oats to the horses”). But in Vermont, cutting taxes would deprive the blood-sucking bureaucrats who parasitically feed off the public tab. Further, we are here considering not income taxes (Laffer) but real estate taxes, where there is a much higher risk of a mismatch between wealth and impact: many people with fixed or low incomes hold appreciated land or buildings and cannot simply grow their incomes to match swollen tax bills.

Consider state taxation of Social Security benefits -- surely cutting taxes on SS beneficiaries is not a boon for the wealthy. Only 13 states subject Social Security income to state income taxes (Vermont being one of them). Increasing real estate taxes across the board in Vermont will disproportionately (regressively) impact retirees and those on fixed incomes.

….there's been some backlash against state income taxes on Social Security, stemming largely from the fact that retirees often leave a state if it costs them money to get their retirement benefits there. States don't want to take the economic hit that results when relatively wealthy retirees go to tax-friendlier states to spend their golden years.

Vermont is home to large numbers of these retirees -- slamming them with spiraling real estate taxes on top of a state income tax on retirement benefits is not exactly equitable. But to the point at hand, cutting those taxes would not be a windfall to the rich.

The Laffer Curve predicts that at some point, increased taxes DO cause people to change behaviors in a way that undermines tax revenue. Vermont is well past that point, by every standard -- and people are leaving. It’s not the wealthy fleeing, but the common workers and businesspeople who see greener tax pastures over most all neighboring state fences. Reducing taxes in Vermont by reducing expenditures would help these residents, not imaginary tycoons who don’t reside here.

Vermont does not need to cut taxes for the rich -- it must cut spending by the bloated bureaucratic behemoth that has become the state’s largest employer. THAT money will not “trickle down,” it will simply stop trickling up from regular folks’ wallets.

Ross Perot was lampooned for his critique of NAFTA, but events proved him right:

The Economic Policy Institute, a left-leaning think tank, concluded that the U.S. lost about 850,000 jobs from 1993 to 2013 as a result of NAFTA and that number has undoubtedly risen.

As Vermont workers and retirees are compelled to tighten their proverbial belts to endure the COVID-19 impacts on the economy, the shocking idea might occur to Vermont legislators that state government may have to do some belt-tightening. This could reverse the giant sucking sound of Vermont homeowners fleeing for friendlier tax climates, before it’s too late.